- 八王子キャンパス

経済学研究科 経営学専攻

- 八王子キャンパス

国際化が進むビジネスシーンで

活躍できる人材育成をめざします

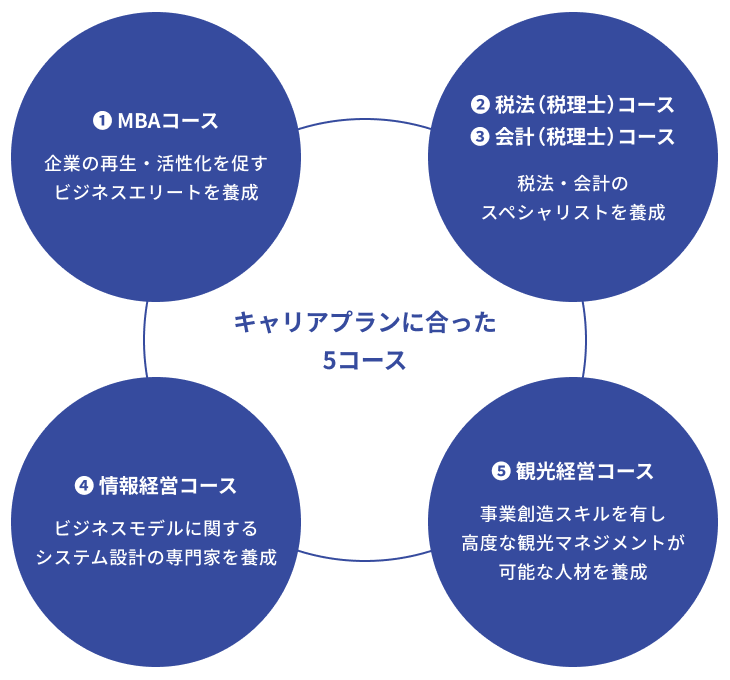

キャリアの出発点となる5コース

博士前期課程には、学生のキャリアプランをサポートする5つのコースを設けています。5コースに共通する情報処理基礎演習や統計学特講などの入門科目、マクロ・ミクロ経済や簿記論特講などの基礎科目を学び、経営学に関する基礎力を固めます。その後、各コースにおける専門的な教育指導を通しておのおのの課題を研究します。

MBAコース

国際的大競争時代において優位に立たなければならない企業の活性化を担う、ビジネスエリートの養成をめざしています。急激な経営環境の変化にも対応できるよう、企業や社会のニーズを反映したカリキュラムを用意しています。

税法(税理士)コース・会計(税理士)コース

税理士をめざす学生を対象に税法、会計に関する高度な知識の修得をめざします。

情報経営コース

経営意思決定に必要な情報処理の技術の習得とともに、新しいビジネス・モデルの構築をめざして、システム設計のできる専門スタッフを養成します。

観光経営コース

観光産業が直面する諸問題に精通し、さらなる発展を実現する事業創造能力の修得をめざします。学士課程(経済学部観光経営学科)のレベルを超える高度な観光マネジメントを担える人材を養成します。

経済学研究科経営学専攻税法(税理士)コース・会計(税理士)コースで税理士をめざす社会人を対象に、税法や会計に関する科目を、帝京大学霞ヶ関キャンパスで開講しています。平日の18:15から授業が始まるので、働きながら大学院に通うことができます。

開講時間

平日(月曜~金曜) 6限(18:15 ~ 19:45)・7限(19:50 ~ 21:20)の時間にて開講

霞ヶ関キャンパスでの開設科目

「税法総説Ⅰ・Ⅱ」「所得税法特講」「法人税法特講」「国際租税特論Ⅰ・Ⅱ」「簿記論特講Ⅰ・Ⅱ」「財務諸表論特講Ⅰ・Ⅱ」「国際会計論特講」「財務諸表分析特講」「税務会計論特講」など

また、社会人の方は社会人入試を利用することができます。

成績評価は、セメスターごとに(通年科目のみの履修者については年度末)にCampusSquareにて発表します。

| 評価 | 評点 | 判定 |

|---|---|---|

| S | 100~90点 | 合格 |

| A | 89~80点 | |

| B | 79~70点 | |

| C | 69~60点 | |

| P | 合格(学位論文審査) | |

| D | 59~0点 | 不合格 |

【MBAコース】【情報経営コース】【観光経営コース】

履修について

修了について

【税法(税理士)コース】

履修について

修了について

【会計(税理士)コース】

履修について

修了について

履修について

修了について